Heading into the Winter Season Strong!

As Winter finally settles in the roaring Fork Valley, and the snow covers up the area, the sun still shines bright on real estate values.

There is no shift for the time being despite high interest rates. The same dynamics that have been in place since COVID are still dominant. The more bullish sentiment that inflation and high rates might be behind us are not factored in yet into this statistical report, so we might see even more green lights in the next few months.

With prices maintaining at a high level, or going up, affordability takes another nose dive, to a level that’s concerning. If the inventory goes up to a level where locals have to be a large part of the demand to absorb such inventory, there is no doubt that prices would fall. But for now, we are not seeing anywhere near that level of supply.

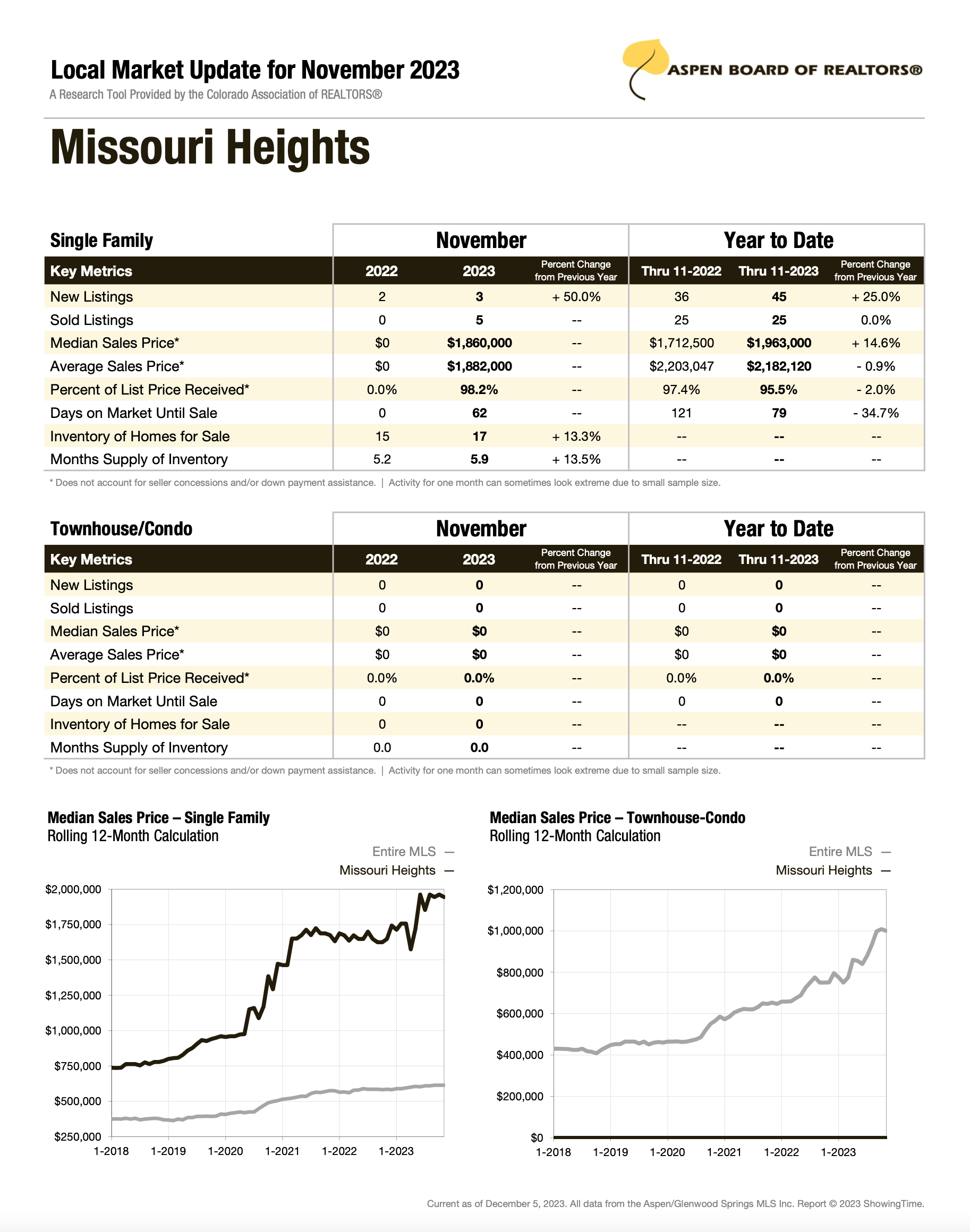

As you will notice in the stats below, some towns show a price decline. It’s worth remembering that the amount of sales is so small that it’s hard to consider them as representative of a trend. For example in Redstone, we see a sale price decline, but there was only 1 sale last month. For that reason, I like to look at year to date (YTD) numbers for the area as a whole to determine the underlying trends.

With median sales prices up 23.5% YTD for the area, new listings down 4.2%, days on the market up 10.2% and the affordability index down 24.2%, this paints the picture of a market still under the same dynamics initiated after COVID:

The low inventory is the main driver of price appreciation.

Price of construction is high and justifies today’s home values

The economy is healthy and employment is abundant

Distressed sales are nowhere to be seen

It’s worth noting though that despite the low inventory, days on the market are going up. That is a sign of exhaustion of this market. Even with just a few options available, it still takes 65 days YTD to absorb the available inventory.

Inflation is not completely under control

With the latest inflation report coming hotter than most were expecting, the hopes of a rapid decrease in interest rates is in question. We could still see an extended period of higher interest rates and higher than 2% inflation. If that’s the case, expect the current dynamic to last: homeowners wanting to stay put resulting in low inventory, high prices, high rents, and high rates.

Stocks and the economy keep widening the gap between wealthy buyers and local workers

Stocks have had an amazing year in 2023, and an even better transition to 2024. This will keep providing more fuel to the buyer’s side in this market, while it only takes a few of them to maintain pricing (low inventory). It will also keep the “up-valley pull” effect in full force. A few sales in the town up-valley from another town pushes buyers that can’t afford that specific town anymore, to go and look into the next town down-valley. By doing so, they also make it not affordable for the demographic who usually buys in that down-valley town. For that reason Aspen sales have an effect on prices all the way down to Parachute. And Aspen is not slowing down in an economy and a stock market that is growing.

This also explains the constant deepening of the affordability crisis in our area, where despite wage growth, homeownership becomes further and further out of reach.

Please find the latest stats and the breakdown per town down below: